Whenever, I call my friends they ask me one “Where NIFTY will go tomorrow ?” or NIFTY prediction in coming days. Now, Honestly writing it – This is very hard question to answer.

However, I’ll teach you one simple technique which will help you predict NIFTY for coming days and will warn you about bad levels.

The amazing ratio

I love this ratio. This is amazing and really helpful. The ratio is P/E ratio or the price earning ratio. I’ve explained this ratio in my past articles. This simple tells you about earnings we receive from company for per rupee invested in the share. The lower the ratio the better it is for value buyers.

Watch Index P/E

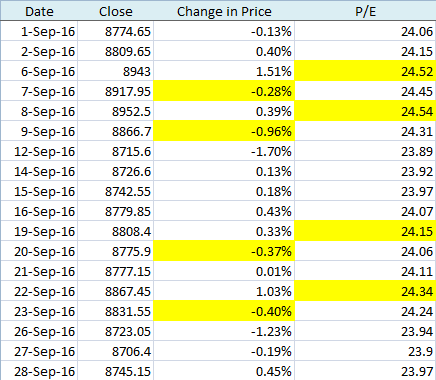

In recent past observation I’ve noticed that whenever the P/E ratio of NIFTY 50 touches 24+. The NIFTY falls down in one or two days. You can also notice this from chart below:

When you see the above chart, you’ll notice on 6-sept the PE ratio was 24.52 and the next day NIFTY decreased. Again on 8-sept the PE hit 24.54 and the next day on 9-sept the NIFTY index decreased.

How to trade this PE data?

You can access the data at the following link: https://www.nseindia.com/products/content/equities/indices/historical_pepb.htm

Normally, you can be in short position when NIFTY PE is 24.5+ or you should stay out of long position when NIFTY P/E is above 24. It’s not 100% of the time correct so be careful before executing the trade.

Precautions and things to keep in mind

Profitability is just one important point.

P/E ration focuses on this only. However, the NIFTY can shift its level of 24+ PE if we have increased liquidity in the market due to huge investment inflow from FII or DII. So, you need to recalculate the peak of PE ratio periodically.

Also, every quarter companies declare their financial results. Some time the overall profitability of companies increasing comparative to previous quarter. This results in higher Earnings or EPS. So, In this case PE ratio of NIFTY Index may also decrease (as the denominator in PE ratio has increased).

So, for the same level of NIFTY this time PE ratio will be less and NIFTY may have more space to move up.

In the last

Don’t forget to share this article with your friends on facebook and twitter.