The CFA Course

Everything About CFA Course and CFA Exam. We Have Been Awarded 8 Times Since’2010.

iPlan Education is providing cfa course coaching classes since 2010. We have completed over 80 batches of cfa program with a success rate of 70%-80%. Awarded 9 times by 6 organizations including Big Research in association with ET Now.

Watch this video

Complete CFA course details

What Is CFA Course ?

Lets understand cfa course details, why and how it is the best program in finance

CFA Course Details

The Financial Analyst Federation (FAF) was established in 1947. They later founded Institute of Chartered Financial Analyst (ICFA) in 1962.

Then the 1st CFA Exam was conducted in USA and Canada in 1963 by ICFA.

The CFA Institute (formerly the Association for Investment Management and Research) merged with the FAF and the Institute of Chartered Financial Analysts (ICFA) in 1990 to boost financial education.

As per latest report 167,000 students appeared in CFA Exam in 2019 from 164 countries.

Registration Eligibility

Normally, student from any academic background or stream can appear in the cfa exam. Following are minimum eligibility criteria:

Ask Your Doubts

Fill the form, our experienced career counselor will guide you.

CFA Course Exams

There are 3 cfa levels / Exams in CFA course. You need to pass all of them one by one. It is known for highest ethical standards.

Level I : This is the introductory level, you learn 10 subjects like Economics, Equity Investments, Fixed income, Financial Reporting and others.

It is conducted four times an year in Feb, May, August and November.

Level II : This is advance level, same 10 subjects but with more advance concepts and applications. It will be now conducted Three times per year Feb, August and November.

Level III : You have only 6 subjects in this level. Same old subjects but now focus is on portfolio management and investment decision with high ethics. CFA level 3 Exam will be conducted in May, August and November

CFA Exam Registration Date & Fee

CFA Institute provides you three registration dates for each exam.

If you register early cfa exam cost you less.

Below fee is for CFA Exam November 2022 and Feb 2023 cfa exam.

| Standard Reg. (FEB-2024) | Early Reg. (May -2024) | Standard Reg. ( May-2024) | |

|---|---|---|---|

| Exam Date Level 1 | 19-25 FEB 2024 | 15-21 MAY 2024 | 15-21 MAY 2024 |

| Registration Ends | 8-Nov-23 | 12-Oct-23 | 06-Feb-2024 |

| Program Enrollment | $350 | $350 | $350 |

| Exam Registration | $1250 | $940 | $1250 |

| Total | $1600 | $1290 | $1600 |

For CFA Level II and Level III you have to pay only exam fee not program enrollment fee. Remember, early registration cost you less.

CFA Exams Pattern

It’s one day exam for each level. CFA Institute will be conducting computer based test – CBT from 2021.

Level I : There will be 90 questions, all multiple choice (MCQ) in morning session and 90 questions in afternoon. There is still no negative marking. You get 2 hours 15 minutes in each session.

Level II : It is again conducted in two sessions. Each session has 10-12 small case studies (vignettes). Each vignettes has 4-6 question. However, Maximum total questions are 44 in morning and 44 in after noon session. There are 3 marks for question.

You’ll have 2 hours and 15 minutes in each session. Level 2 exam will be also CBT.

Level III : You have 8-11 Essay type subjective questions in the morning session. Later in afternoon you have 44 multiple type questions in vignettes format with no negative marking. You have same time in each session and it’s is also CBT.

CFA Subjects never changed in last 10 years. However, There are small changes in the cfa course syllabus and subject wise weightage every year.

~Pravin Khetan

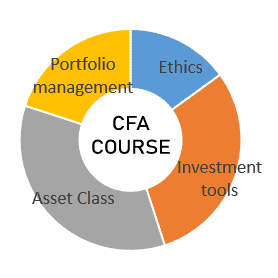

CFA Course Syllabus

CFA course syllabus is decided by Cbok (candidate body of knowledge). During one day exam questions from all subject are asked in the paper.

cfa course syllabus assigns subjects wise weightage in the question paper.

| Subject | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Ethical And Professional Standards | 15-20% | 10-15% | 10-15% |

| Quantitative Methods | 8-12% | 5-10% | 0 |

| Economics | 8-12% | 5-10% | 5-10% |

| Financial Reporting and Analysis | 13-17% | 10-15% | 0 |

| Corporate Finance | 8-12% | 5-10% | 0 |

| Equity Investments | 10-12% | 10-15% | 10-15% |

| Fixed Income | 10-12% | 10-15% | 15-20% |

| Derivatives | 5-8% | 5-10% | 5-10% |

| Alternative Investments | 5-8% | 5-10% | 5-10% |

| Portfolio Management | 5-8% | 10-15% | 35-40% |

| Total | 100% | 100% | 100% |

CFA Exams Locations

There are currently 200+ cfa exam locations worldwide.

CFA exam is conducted in 10 cities in India: Ahmedabad, Bangalore, Bhopal, Chennai, Hyderabad, Kolkata, Lucknow, Mumbai, New Delhi, Pune.

However, this is subject to change. Kindly check the center during cfa exam registration.

Value of CFA Course in India

CFA Job Profiles

| Job Profiles | Ratio% |

|---|---|

| Investment and Fund Management | 22% |

| Financial Reporting | 12% |

| Investment Banking | 10% |

| Wealth Management | 6% |

| Equity Research | 6% |

| Private Equity | 6% |

| Risk Management | 6% |

| Research | 4% |

| Corporate Banking | 4% |

| Management Consultancy | 4% |

| Fixed Income or Bonds | 4% |

| Derivatives | 3% |

| Hedge Funds | 3% |

| IT | 3% |

Top Companies Hiring CFA

- BlackRock

- Vanguard

- Blackstone

- Goldman Sachs

- UBS

- Fidelity

- Morgan Stanley

- Nomura

- J.P. Morgan

- BNP Paribas

- Bank of America

- HSBC

- Barclays

- RBS

- Deutsche Bank

- Allianz

- Apollo Global Management

- Citi Bank

- HDFC

- ICICI

- Edelweiss

- S&P

- Moody’s

- Fitch

- +200 more companies worldwide.

What is CFA® Charter?

CFA ® Charter a credential/designation, this is awarded to candidates who have passed all three levels of CFA program and holds experience of minimum four years in investment and finance profile.

After Passing CFA course all three levels, you have to apply for CFA charter with 2-3 professional references.

Once you are a CFA charter you can use it as credential or designation before your name.

It doesn’t have any statutory right in India like CA or CS. However, as per the SEBI guideline if you start your Advisory or Portfolio Management Services, CFA qualification is considered to get SEBI licence.

Is CFA Charter a degree?

Often CFA charter is misunderstood as a Master Degree like MBA. It’s not a master degree in India.

It’s a professional credential that demonstrates your expertise in equity analysis and portfolio management.

Normally, in MBA program you learn business administration and in cfa course you learn financial analysis.

A lot of people after MBA, CA, ACCA or CPA also pursue CFA to become expert in financial analysis, it holds great value in industry.

Few companies where our students are placed

It all happened because of 10 years of strong alumni relations

Hope, you got all the CFA course details!

It’s time to check coaching classes. Else, if doubts remaining ask us.