Derivative / Option Strategies Course

Learn future, call and put option strategies course. Also, know as derivative strategies by best faculties in India. Awarded 8 Times Since’2010.

iPlan Education is providing option strategies course online and offline since 2010. We have complete over 250+ batches of stock market courses. We can proudly say all our students have evolved and become good traders.

Awarded 8 times by 6 organizations including Big Research in association with ET Now.

Quality Delivery Comes With Experience

Here, is a sample Option Strategies course video.

Delivering Derivative / Option Strategies Course Since 2010

Here are few features of our call and put option strategies course.

80K

Followers

9K

Trained

250+

Batches

4.6/5

Rated

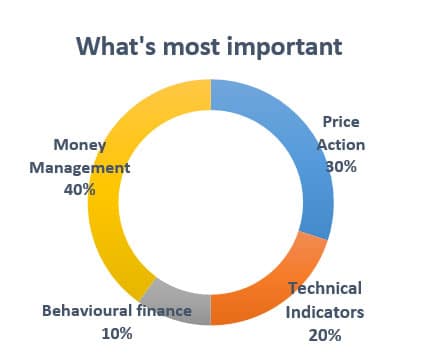

What we should focus in future & option strategies course

There are different market sentiments like some times market is bullish or bearish, we must first identify the market sentiment. Then, we should figure out – Is it good for intraday, few days or shall we carry position till expiry. As, any option strategies must be applied keeping in mind market sentiment, volatility, liquidity, duration and miss-pricing in the market.

Also, as an option trader we must accept this fact option writing is safer than buying option contracts. So, only focusing on buying options will not be fruitful in long term. Have, enough capital for both long and short positions.

Topics Covered

Future Contracts

- Introduction to Forward contract

- Future contract concept

- Future Pricing concepts

- Marking to market and margin call

- Backwardation and contango contracts

- Future contract live trading

- Hedging using future contract

- Arbitrage using future contract

- Trading on calendar spread

Option Contract

- A to Z of Call Option trading

- A to Z 0f Put Option trading

- Live trading in option contracts

- Margin and premium calculation

- Intrinsic value and time value concepts

- India VIX Index

Option Greeks

- Delta

- Gamma

- Vega

- Theta

- Rho

- Using Option Greeks Calculator

- Using option greeks in intraday

- Delta Hedging

30+ Option Strategies

Basic Option Strategies

- Bull Call Spread

- Bull Put Spread

- Bear Call Spread

- Bear Put Spread

- Cashbacked Long Call

- Covered Call

- Protective Put

- Long Straddle

- Short Straddle

- Long Strangle

- Short Strangle

- Ratio Vertical Spread with Put

- Volatility Spread with Call

- Long Calendar spread With Call

- Short Calendar spread With Call

- Long Calendar spread With Put

- Short Calendar spread With Put

Advance Option Strategies

- Long Butterfly Spread With Call

- Long Butterfly Spread With Put

- Short Butterfly Spread With Call

- Short Butterfly Spread With Put

- Long Iron Butterfly spread

- Iron Condor Spread

- Short Condor Spread with Call

- Short Condor Spread with Put

- Collar

- BOX

- Risk Reversal

- Covered Straddle

- Double Diagonal Spread

- Long Christmas Tree with call

- Long Christmas Tree with put

Why future & option strategies course with us.

Training Features and Facilities

Delhi

Patel Nagar

Mumbai

Thane

Hyderabad

TBA

Rest

Online Class

Derivative / Option Strategies Course Options

Select option strategies course, if any query fill the form below.

Certificate in Option Strategies

Duration : 1.5 M

Mode : Classroom / Online

Timing: Weekday/Weekends

Premium Option Strategies Study Pack

Validity : 3M

Mode : Online

In case you need any help!

Fill the form below

Their words tell you more about us

Special thanks to Pravin Sir.